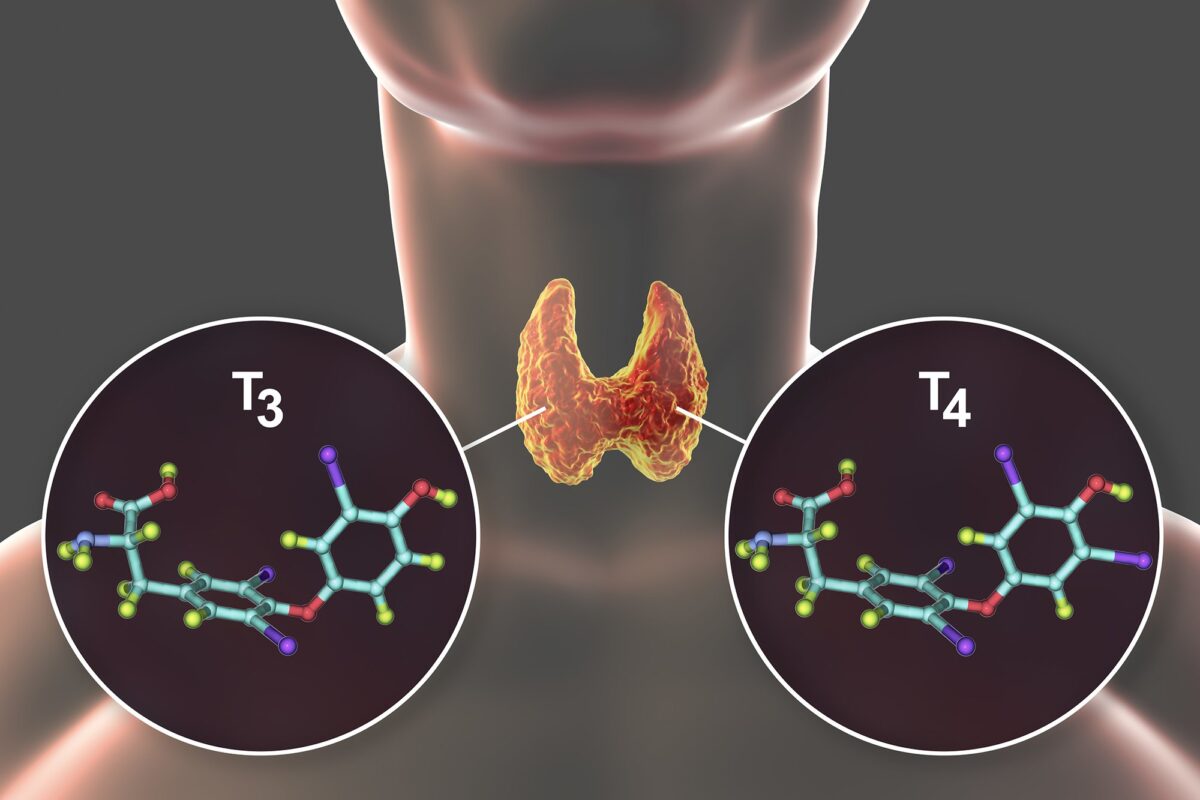

What Is The Difference Between T3 And T4 In Thyroid Function?

If your investment account is owned jointly with your spouse, you will receive a T5 slip in both names. If you both contributed equal amounts to the investment, each person can report 50% of the taxable income amount. You can also claim the income proportionally, based upon who contributed what.

HOW TO CONVERT Your Volkswagen T4/T5 into a Camper Van by Butcher, Lawrence, NEW £19.67

All the three T4, T4 A and T5 slips represent the income you have earned in a year as an employee, through commission, interest or a scholarship fund. All slips are compulsory to include to completely file your tax return. In case you forget to attach any of these slips, the CRA will know it already. The CRA has a copy of these slips to cross.

Error in T4/R1 Quebec Slips

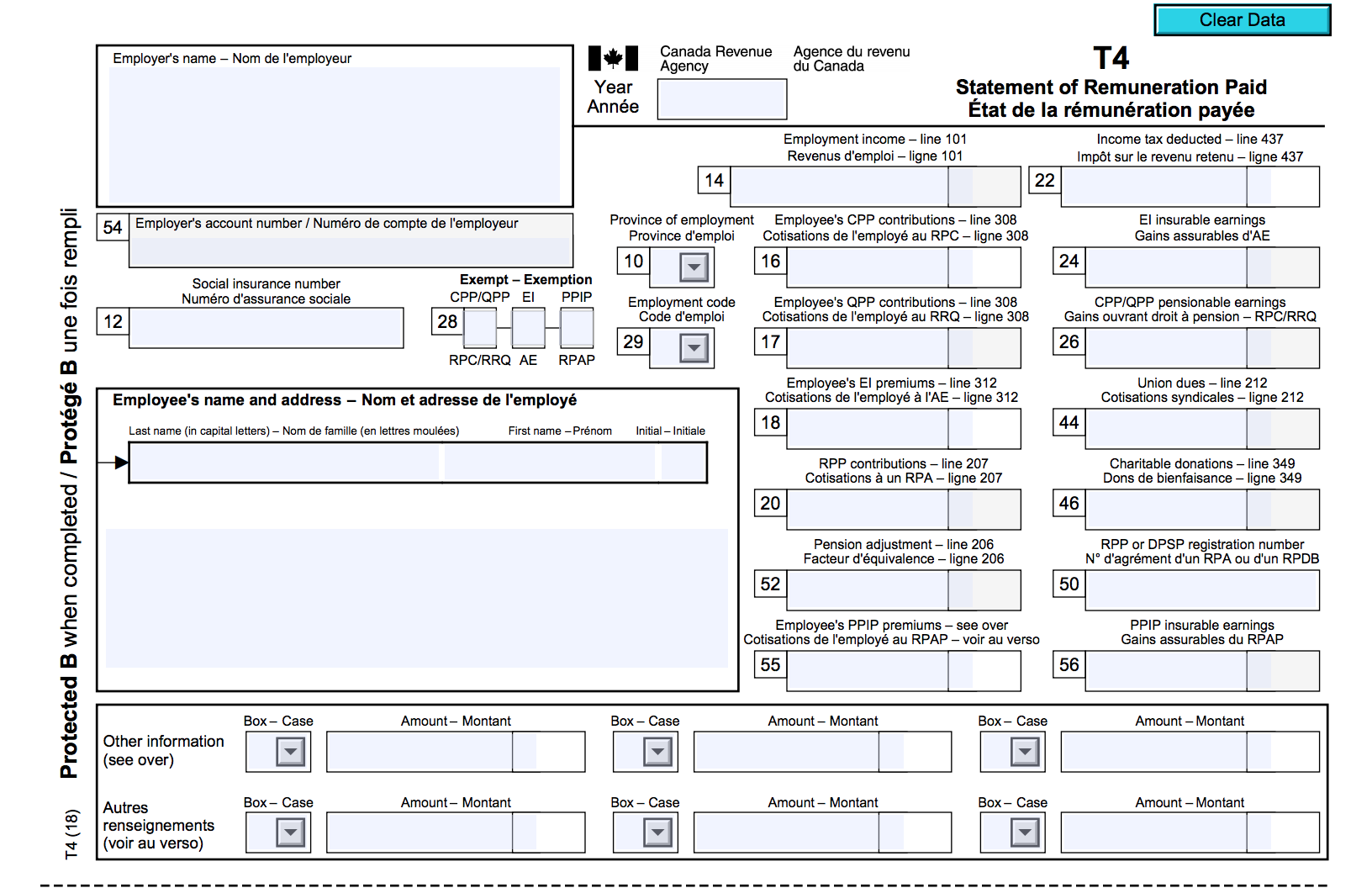

Read on to discover the differences between a T4, a T4A and an RL-1 slip so that you can get a better understanding of your tax return. Here's What We'll Cover:. If you are a salaried employee then you may well have heard of a T4 slip or a T4 tax form. Also known as a Statement of Remuneration Paid, a T4 slip is a summary of your.

T5 vs T4 in OPEN FIELD Choose Wisely Rise of Kingdoms YouTube

Each tax season many Canadians puzzle over the difference between a T4 and a T4A. While the names are similar, these forms are used for very different purposes. Knowing the distinction is important to file a proper return. Our aim is to make filing your taxes as simple and stress-free as possible. So let's look at some differences between.

T5 Tax VW T4 Forum VW T5 Forum

Dividend tax credit: $13,800 x .150198 [15.0198 / 100] = $2,072.73 flows through to T1 line 40425. Example of an other than eligible dividend gross-up and tax credit: Taxable eligible dividend paid: $10,000 reported on T3 or T5 tax slip. Gross-up: $10,000 x 1.15 = $11,500 flows through to T1 line 12000 & 12010.

What are a T1 General, NOA, and, T4 Your Edmonton Mortgage Broker Natalie Wellings

Learn the difference between a T4 vs T4A, when you should send them out, and any penalties small businesses may face.. Income tax; A T4 may be given in paper form or an electronic version to an employee from their employer by the end of February. A few key pieces of information it contains are an employee's SIN number, the gross income.

5 Differences Between The VW T5 And T6 Transporter (WHICH IS BEST FOR A CAMPER?) YouTube

The T5 slip features various boxes that specify what information to enter on your tax return. Here's a breakdown of all the boxes you will encounter on your T5. Note: some boxes will need to be self-identified if needed — in these cases, identify a box in the "Other information" area as the box number your amount corresponds to. Box. Meaning.

T4 vs T4A Differences When To Issue Which Slip? Filing Taxes

The main differences between T1 vs. T4. While the T1 and T4 sound similar, there are many important differences between the two. First, they differ in terms of purpose. The T1 General is your personal tax form. This is the document you submit to the CRA in order to officially file your individual tax return.

Difference Between T3 and T4

When it comes to understanding your T4A slip, the most important thing to remember is that you must report all of the income you receive during the tax year. Not all income you earn will be taxable, but everything must be reported to the CRA. This article explains the difference between T4 and T4A tax slips. Self-employed or receipt of pension.

Tax Filing Deadline T4, T5 and T4A YouTube

At first glance, T4 and T4A slips may appear similar. However, they have a few crucial differences. Most importantly, you'll need to file a T4A if you received any self-employment income during the past year. The T4A is a Statement of Pension, Retirement, Annuity, and Other Income.

What Is The Difference Between T3 And T4 In Thyroid Function?

Know the Differences Among a T4, T4A, and T4A-NR Slips. In general, use a T4 (Statement of Renumeration Paid) slip to report the income you paid to your employees over the previous calendar year to the Canada Revenue Agency (CRA). This income includes regular salaries, hourly wages, contributions to the Canada Pension Plan (CPP), and Employment Insurance (EI) premiums.

Klenow dan T4 DNA Polymerase dalam IPA, pengertian, perbedaan

A Guide to Canadian Tax Slips: T4 vs. T4A vs. T5. Tax time can be confusing. There is so much to keep track of! Tax slips, receipts, and so much more! In this blog post, we will outline the most common tax slips that you will receive at tax time, the T4, T4A, and T5. We will also cover some of the key differences between each of these tax slips

Difference Between Vw T5 And T6 truongquoctesaigon.edu.vn

The T4, or Statement of Remuneration Paid, is a tax slip that employers issue to employees after each calendar year. It includes your earnings, deductions and tax paid so far. The T4A is another.

HOUSING T4T5 SMALL WIDTH

The difference is that they apply to different kinds of institutions. While the T2202 is issued by Canadian colleges, universities, and educational institutions, the TL11 forms apply to the following people:. Understanding tax terminology can pay off! T4. If you've heard of at least one thing on this list, it's probably this form. The T4.

Części Volkswagen T4 Caravelle Wrocław Break

The T4, T4A and T5 payroll slips are a representation of your employment or commission income from a certain employer (T4, T4A) or investment income (T5). Any slip that is provided to you is also provided to the CRA. This means that if you avoid inputting a T4 slip, the CRA will know because they will cross-reference your personal tax return to.

The Canadian Employer's Guide to the T4 Bench Accounting

A T4 slip, or "Statement of Remuneration Paid," is a tax form produced by an employer and furnished to both an employee, as well as the Canada Revenue Agency (CRA). The form includes wages paid and taxes withheld, as well as assorted other information, such as amounts contributed to pension plans and employment insurance.