2024 Statement Form Fillable, Printable PDF & Forms Handypdf

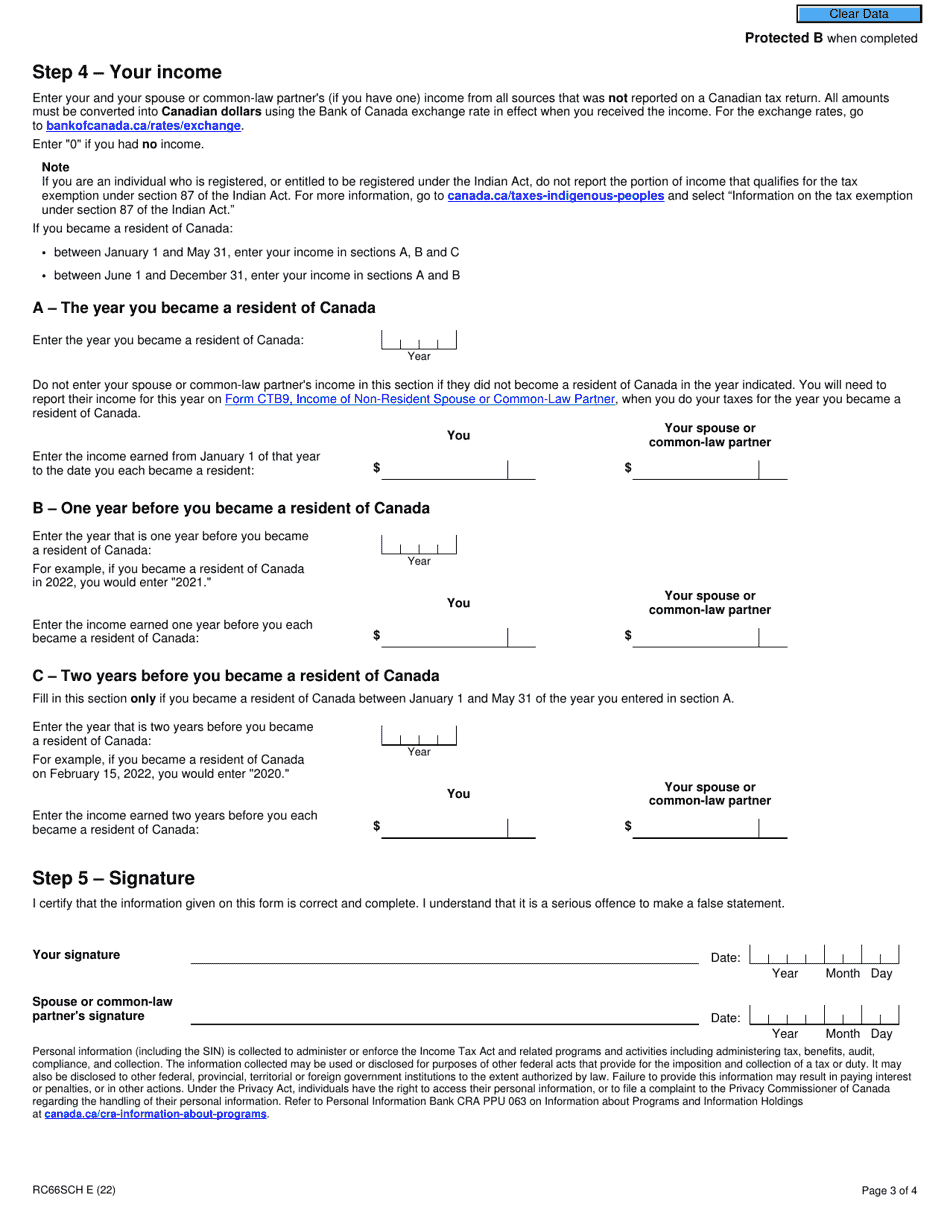

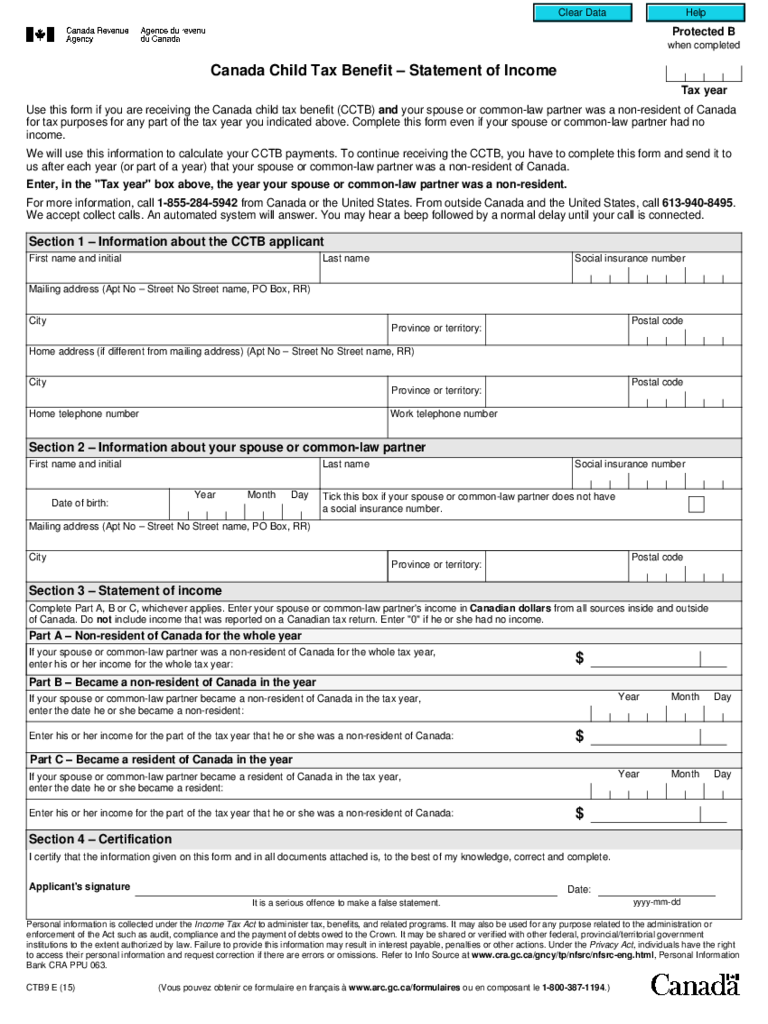

Fill out and sign Schedule RC66SCH, Status in Canada/Statement of Income; Mail Schedule RC66SCH and Form RC66, Canada Child Benefits Application to your tax centre. If your spouse or common-law partner is a non-resident of Canada during any part of the year, you must fill out Form CTB9, Canada Child Benefit - Statement of Income for each year.

Tracking company and expenses is easier with an Excel profit and loss template Profit

Status in Canada / Statement of Income when completed Complete this schedule, and attach it to your Form RC66, Canada Child Benefits Application, if you or your spouse or common-law partner: • became a new resident or returned as a resident of Canada in the last two years; • became a Canadian citizen in the last 12 months; or

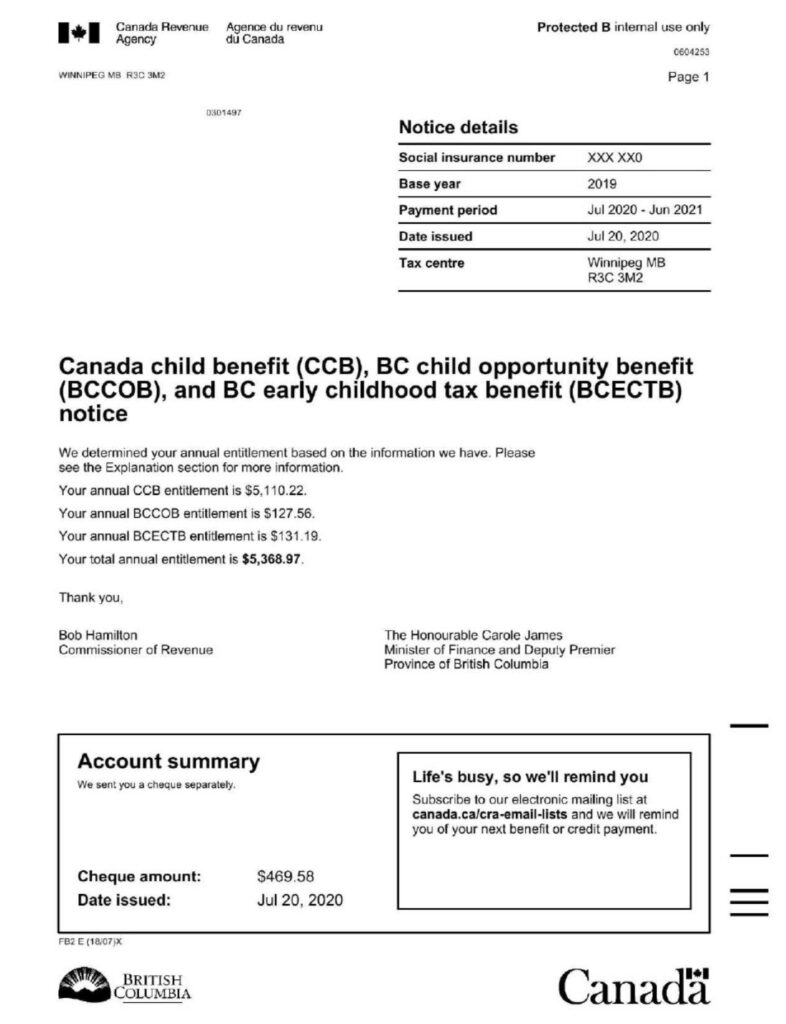

2011 Form Canada RC66 E Fill Online, Printable, Fillable, Blank pdfFiller

The Canada Revenue Agency (CRA) has designed form RC66SCH for those who are not Canadian citizens but who wish to apply for the Canada Child Benefit. For example, those who have just become a resident of Canada in the last two years or those who became a citizen of Canada in the last 12 months can use this form.

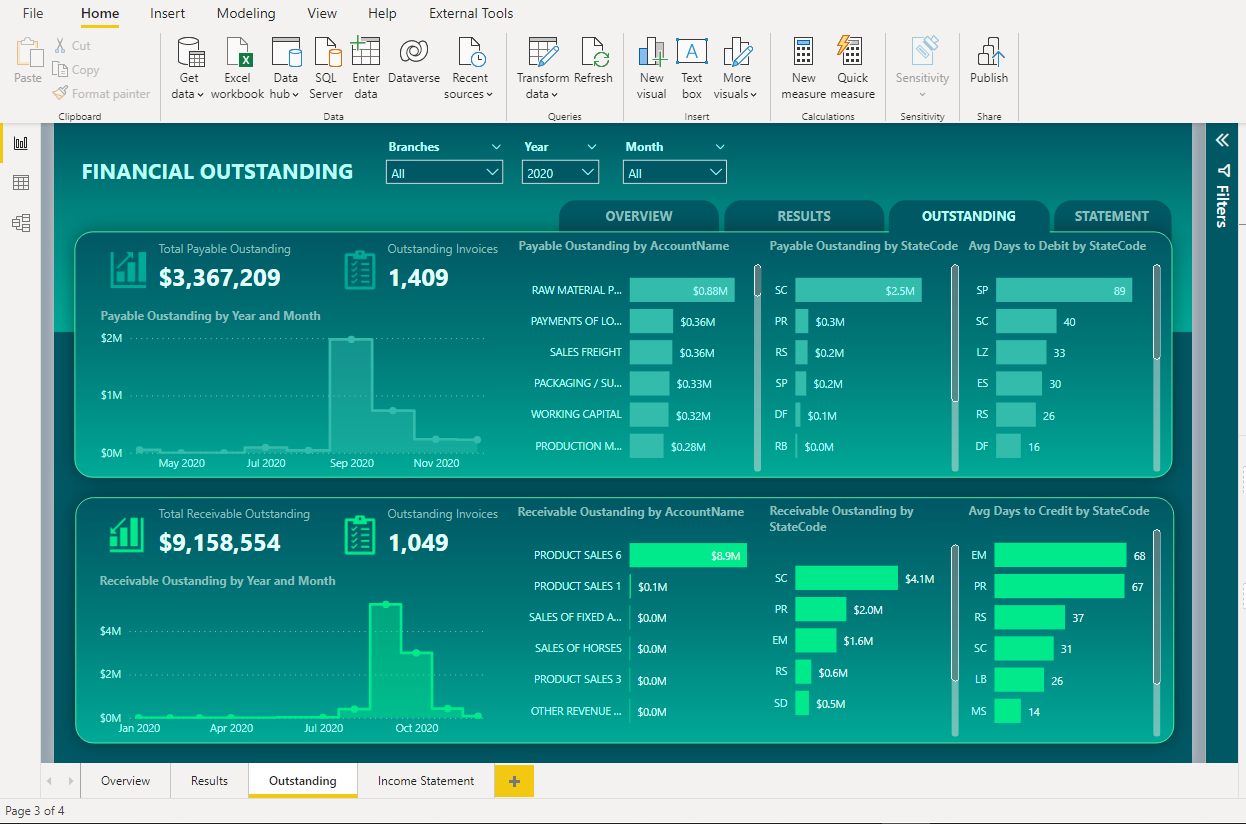

Statement Dashboard in Microsoft POWER BI Eloquens

You can also apply for the CCB by using "Apply for child benefits" in My Account or by sending Form RC66, Canada Child Benefits Application. You must also fill out and attach to your application Form RC66SCH, Status in Canada and Income Information, if any of the following situations apply. You or your spouse or common-law partner:

How To Find Out Child Benefit Number Wastereality13

RC66SCH Status in Canada and Income Information for the Canada Child Benefits Application Download instructions for fillable PDFs.. Fill out this form if you became a resident of Canada, became a Canadian citizen, are a permanent resident, protected person, or temporary resident, or are registered or entitled to be registered under the.

Form RC66SCH Download Fillable PDF or Fill Online Status in Canada and Information for

Schedule RC66SCH, Status in Canada/Statement of Income. Send us your Form RC66 along with any required schedules and documentation as soon as possible after you and your child arrive in Canada. In addition to the CCB, you can also receive a CDB if your child meets the criteria for the disability amount and we approved

2024 Child Tax Benefit Application Form Fillable, Printable PDF & Forms Handypdf

Application, the RC66SCH, Status in Canada / Statement of Income and the CTB9, Canada Child Benefit - Statement of Income forms. CRA has identified several problematic areas with the current forms, including: • Clients not understanding the different marital status options;

Business Statement Template Shooters Journal Personal financial statement, Financial

3. You must be a resident of Canada for tax purposes. We consider you to be a resident of Canada when you establish sufficient residential ties in Canada. For more information, see Income Tax Folio S5-F1-C1, Determining an Individual's Residence Status. 4. You or your spouse or common-law partner must be any of the following: a Canadian citizen

Fill Free fillable Status in Canada and Information (Government of Canada) PDF form

Fill out this form to apply for the Canada child benefit and register your children for the goods and services tax/harmonized sales tax (GST/HST) credit, the climate action incentive payment, and related federal, provincial, or territorial programs. Ways to get the form. Download and fill out with Acrobat Reader

Statements Explained Definition and Examples Pareto Labs

Part D - Statement of income. Complete this part if you or your spouse or common-law partner became a new resident of Canada or returned as a resident of Canada. Enter all income in Canadian dollars from all sources inside and outside Canada. Do not include income that you, your spouse or common-law partner have reported on a Canadian tax return.

The cool Non Profit Statement Template Free Spreadsheet With Regard To Non Pro… in 2020

Send us your completed Form RC66, Canada Child Benefits Application, and any required documents in the envelope included with your package. If you do not have the preprinted envelope, send the information to one of the following. You must also complete and attach schedule RC66SCH, Status in Canada/Statement of Income, if you or your spouse.

Child Tax Benefit Application Form Rc66sch CVACLAN

Fill PDF Online. Fill out online for free. without registration or credit card. Form RC66SCH Status in Canada is a Schedule that is used to provide income information for the Canada Child Benefits Application. This form helps the Canadian government determine if you are eligible for child benefits based on your income.

Proof Of Other Form How to create a Proof of Other Form? Download this Proof of

Use this form to report your world income and residency status for the Canada child benefit. Download, print, and mail it to your tax centre.

Form RC66SCH Fill Out, Sign Online and Download Fillable PDF, Canada Templateroller

RC66SCH - Status in Canada and Income Information form. RC66-1 - Additional Children. Proof of birth of child. Proof that you resided in Canada. Proof that you are primarily responsible for the care and upbringing of the child. Proof of citizenship, or your immigration status in Canada

Sensational Monthly Statement Template Financial Ratio Analysis Formula Trial Balance

Fill out this form if any of the following situations apply. You, your spouse or common-law partner (if you have one), or both of you: In this form, you will provide information about your and your spouse or common-law partner's residency status, citizenship and immigration statuses, and income. This information is used to determine your child.

Basic Statement Template Beautiful Basic In E Statement Template Excel Spreadsheet Notes

In this form, you will provide information about your and your spouse or common-law partner's residency status, citizenship and immigration statuses, and income. This information is used to determine your child and family benefits and credits. You do not have to fill out this form if the information was previously submitted and has not changed.